Short Sales 101

DEFINITIONS

- Foreclosure – A legal process in which, against the wishes of the owner, real property is sold to satisfy a public or private debt for which the real property has been pledged as security.

- Notice of Default (NOD) – a notice that is filed with the county recorder when a homeowner is not current on the loan that is secured by the homeowner’s property. If the default is not cured within a statutory period of time, the lender can move to auction the property to the highest bidder.

- Foreclosure Sale (NOTS) – The actual sale of real property at the conclusion of a foreclosure proceeding. The sale may be to a third party as a result of a high bid, or to the foreclosing creditor (the lender) if there are no bids higher than the amount of the defaulted debt plus foreclosure costs. If the sale generates proceeds beyond the satisfaction of the debt and foreclosure costs, the balance generally must be refunded to the party who has lost the title to the property. (the homeowner)

- Real Estate Owned (REO) – A real property that has been foreclosed by a lender and is now owned by the lender.

CALIFORNIA FORECLOSURE PROCESS

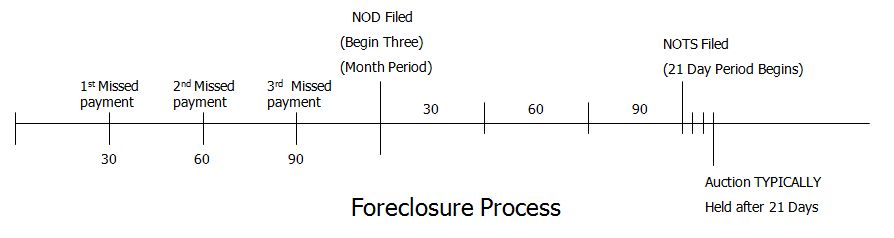

The timeline displayed here is typical in a California non-judicial foreclosure. The foreclosure timeline does not begin until the lender feels they have exhausted all avenues for curing the payment delinquency. Normally, this happens after the borrower has missed 1 to 3 monthly mortgage payments. The borrower has probably been contacted by the lender several times prior to beginning the foreclosure process. The official foreclosure process then begins by the lender contacting a Trustee and instructing them to file a Notice of Default.

NOTICE OF DEFAULT TIMELINE (NOD)

- Day 1 – Notice of Default recorded with County Recorder.

- Within 10 business days – notice of default is mailed by the Trustee to the borrower and includes the recording date.

- Within 1 month – Notice of Default is mailed to the borrower again.

- At 90 Days – Notice of Default period ends and Notice of Trustee Sale period begins.

NOTICE OF TRUSTEE SALE (NOTS) – 21 DAYS

- After 90 Days – Sale date, time, and location are set.

- 30 days prior to sale date – Notice of Sale is sent to IRS (if applicable).

- 20 days prior to sale date – Notice of Sale is published in a newspaper and is required to run for 3 consecutive weeks. Notice of sale is posted on the property. Notice of sale is mailed to the borrower and required parties involved.

- 14 days prior to sale date – Notice of Sale is recorded in County Recorder’s office

- 5 days prior to sale date – “Your RIGHT to reinstate expires”

- Sale Date – The property is sold to the highest bidder or reverts back to the lender as an REO (bank-owned) Property

HERE’S WHAT ONE CLIENT DID…

He lived Rent Free for 4 months: Monthly Payments he did not make – Payment: $2,480 X 4 months = $9,920.00. Was able to sell the home as a Short Sale and avoid the ‘Foreclosure’ ding on his credit. If a short sale is an option, it can be a positive outcome for ALL PARTIES.

FAQ

Will there be any tax consequences to doing a Short Sale?

Typically, the tax consequences will be less severe vs. letting the home go to foreclosure. If the home is sold at foreclosure auction, you will still receive a 1099-A for the amount the lender lost due to the sale. In a short sale, most lenders (except for those that are out of business and not worried about the O.T.S.), will ALWAYS give you a 1099-C for the amount they have lost due to the short sale, if they decide to not seek a deficiency judgment (in almost EVERY case they will opt to send you a 1099-C for the amount of the loss). We always recommend that you consult with a CPA regarding taxes. Additionally, we recommend that you become familiar with IRS form 982 prior to deciding the pursuit of a short sale.

Can the bank give me a 1099-C and report my credit as paid less than agreed?

Legally? No. Do they do it anyway? Yes. So, you will need to keep that 1099-C as proof that they ‘wrote off’ that loss by essentially ‘giving you the difference of the purchase price and amount owed as income’. The bank can not legally report ‘paid less than agreed’ to the credit bureaus if they accepted partial payment of the note and also sent you a 1099-C (income to you) for the difference of that note. Talk to a Real Estate Attorney for clarification on the subject. If needed, you or your attorney can contact the bank at a later date about ‘fixing’ their slight oversight in sticking it to you twice.

Can the bank seek a ‘deficiency judgment’ for the amount they lose by accepting a Short Sale?

In most states, yes, but a lot of the time they will opt to send you a 1099-C and write it off as a loss on their books. The thing that you should know is that VERY FEW lenders will seek a deficiency judgment due to the cost to get the judgment and due to the fact that you probably can’t pay it anyway. 99.99% of the time the lender will send you a 1099-C instead of even worrying about the deficiency judgment, even when they can legally seek that option. Once they have sent you a 1099-C, they cannot seek a deficiency judgment. They can only do one or the other, not both.

How does a foreclosure versus a Short Sale show up on a homeowner’s credit?

It depends on how the creditor reports it to the credit bureaus. Generally, a foreclosure will show up as a FORECLOSURE and can stay on a homeowner’s record for up to seven years. Anytime the homeowner applies for a new loan or has their credit run, the foreclosure will likely show up. More and more employers are running credit for job applicants. A Short Sale is listed as SETTLED DEBT and is much less harmful to the homeowner’s credit than a foreclosure. It is not Paid in Full as it would be if the full balance was paid off on the mortgage, but a Short Sale is much better credit-wise than a foreclosure. We recommend that you consult a credit company for more information.

What is a Deficiency Judgment?

When a creditor (lender) files a lawsuit against a debtor (borrower) through the courts in an attempt to collect an amount not covered by the value of the security that was put up for a loan or installment payments. In other words, if the lender recoups less money than is owed, whether it be via Short Sale or foreclosure, then they have the right to collect whatever the difference is. However, with the right negotiator working on the borrower’s behalf, the deficiency judgment rights can be waived.

Why should I do a Short Sale? If I am going to have to move anyway, why shouldn’t I just allow the bank to foreclose so I can stay in the house rent-free for longer?

The main benefit of a short sale is that many in many instances you can still stay in your home rent-free just as long as if the house were to go to foreclosure and you will still be able to show your mortgages as “paid in full” vs. “foreclosure”. The amount of loss to the bank is usually less in a short sale, thus the amount of the 1099 to the homeowner in a short sale is less. You will also want to have an expert on your side dealing with the lender. If you allow your home to go to foreclosure, there is no one there to help you clean up the mess and pick up the pieces as you struggle with bad credit for the next 7-10 years.

HAPPY Loft owners (SAVED CREDIT, loan is reported to credit bureaus as PAID IN FULL).

HAPPY Lenders (Avoided Foreclosure process & legal fees).

HAPPY Buyers (They bought at a discount)

HAPPY Agents (we did our job in selling your loft)

CONTACT US TODAY, WE HAVE DONE SHORT SALES AND WE KNOW WHAT TO DO, AN UNEXPERIENCED AGENT CAN COST YOU TIME AND MONEY

More info here: https://ipropertymanagement.com/laws/california-landlord-tenant-rights

Are you looking to buy or sell a loft? Let us help you. Just fill out as much of the information below as you want and we’ll get right back to you, with no obligation to you. We guarantee your privacy.